NOTE: This post was written using data gathered up till 31st July 2022.

During July FOMC, the Fed raised rates by 75 basis points bringing the funds rate in the range of 225 to 250. This post will explore current market expecatations and implications for investors moving forward.

- Nominal Rate expectations:

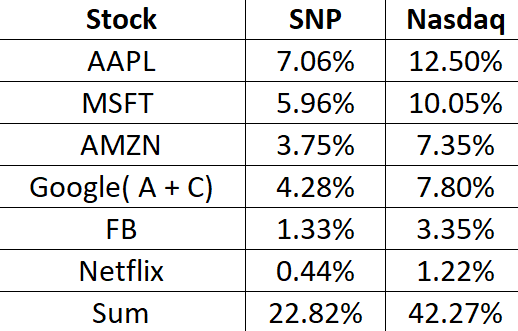

Current market yields:

Implied yield expecations from treasury futures:

This tells us that nominal rate expectations imply that rates still have room to move a little further upwards. However, the short end of the curve (2year) is going to move upwards more than the long end (10 year).

Spreads are basically down to zero and below, implying the market is pricing in a recession.

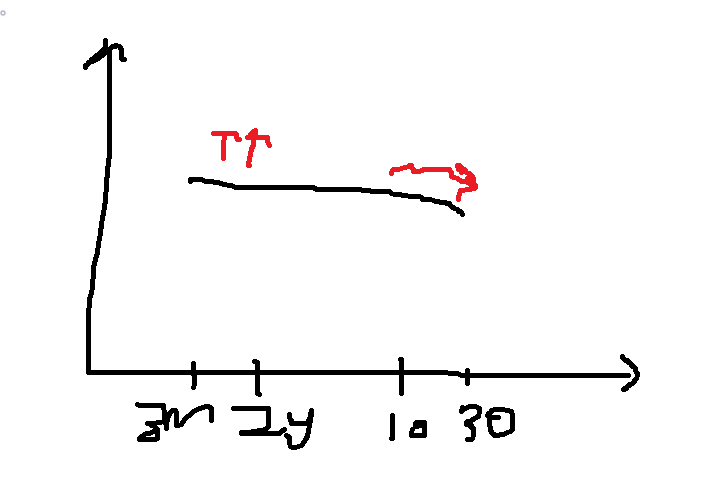

With such a flat nominal yield curve, we can draw the following rough sketch of yield expecations:

The short end is expected to continue rising a little bit, the long end will remain where it is, possibly even moving downwards slightly due to economic slowdown.

After the June CPI release, the most significant thing to happen in bond markets was that 2 year yields went up, BUT 10 year yields did not move up in tandem by the same amount, which means post June CPI release, markets increasingly pricing in a recession.

2. Inflation Expectations:

Here is where things get really interesting.

Current CPI is at 9.1%, 5 year tips spread is at 2.73% and 10 year tips spread is at 2.53%.

After the FOMC meeting, inflation expectations for 5 and 10 year actually went up! This is because the Fed did not raise rates by 100bps, and the probability of containing inflation went down, resulting in higher inflation expectations.

1 Year inflation expectations also moved up to around 2.5% (according to data from ICE Intercontinental Exchange)

Inflation expectations are by no means unanchored, but have definitely moved slightly higher.

What does this imply for the current real yield curve?

As the year moves along, real rates at the short end will move upwards swiftly as inflation comes down and nominal rates move up.

At the long end of the curve, assuming inflation remains constant, real yields will slowly move and hover around zero percent for 5 year and 10 year.

3. Impact on Gold:

As short rates move up swiftly, it will put downward pressure on the price of Gold.

Before the pandemic happened, when the 10 year real yield was in the range of 0.5 to 0%, which was May – Aug 2019, price of gold was in the 1300 – 1500 range. Which means the current price of Gold at above 1700+ is way too high given the changes in the real yield curve that is to happen. As such, my expectation is for Gold to trade somewhere between 1500 to 1700 moving towards the end of the year, but definitely not above 1700 as inflation comes down, and real yields at the short end move swiftly upwards.

4. US Stocks:

As US economy moves into recession, and short rates move up, cost of debt increases, while corporate profits decrease or grow at a slower rate, stocks will be trading at lower multiples than what is currently priced in. Bearish call on the stock market. Even if PE ratio does not change, assuming a PE ratio of 20, as earnings growth decline, prices decline.

5. Bonds:

This is where things get interesting.

Short term maturity debt is great for excess cash right now given high rates.

In addition, it might be good to load up on some TLT as long rates continue to face downward pressures due to slowing economy. However, I feel that the best time to buy into long rates is when Fed policy becomes more clear, will they hike above 3% or remain at 3%? If they remain at 3%, then load up on TLT. If they hike above 3%, we need to see if long rates move up in tandem, and if so by how much.

6. Commodities:

(Not a commodity expert so leaving section blank for future posts)

7. Currencies:

Most of the significant moves in major currency markets have already happened as yield spreads between the US and EU/JP widen. Unless the EU/JP swiftly change monetary policy, the Euro and Yen will remain devalued against the dollar.

For Yuan, expect deprectiation pressure as global physical trade slows down. Will PBOC step in to maintain the current rate at 6.7 or allow further depreciation to 7 remains to be seen.

8. HK Stock:

With a tightening Fed and QT happening, global liquidity growth goes to zero and even negative, bearish on HK and KR stocks.

9. CN Stocks:

Chinese stocks follow a different cycle to the rest of the world in that their earnings growth component depends largely in part on domestic economic policies (excluding the exporters).

The problems of the property market, and a very strict COVID-19 policy imply that China faces significant headwinds moving forwards. The three largest drivers of economic growth in China are Exports, Investment, and Consumer Spending. With a global recession and de-coupling occurring, export growth will slow significantly. Consumer Spending remains depressed due to the lockdowns. What remains is government investment in infrastructure projects. The problem this time is that these projects are no longer financed by land sales, but by issuance of government debt. As such, China’s debt to GDP ratio is going to increase towards the end of the year, possibly even up to 290% of GDP. The catalyst for Chinese economic growth remains to be seen, and we will have to wait until after the October party congress for any significant changes to COVID-19 policy.

As always, China is a long play. If you believe they can overcome the middle income trap (which is exacerbated by de-globalisation) and change into a consumer driven economy, then stay long. But if you believe they cannot make it and will face a period of huge debt deflation, something like Korea during the AFC, then you shouldn’t be long China.

Some might argue that China pulled through in 1991, 1997, and 2008, so they can pull through again. I beg to differ as the debt to gdp ratios at those points in time are drastically different to what we see today. Moving forwards, I think the Chinese economy growth rate will continue to slow, there will not be any significant “boost” as the central government needs to maintain a stable debt-gdp ratio, For those who are long-china, wait until october.

10. Oil Supply:

As long as the US, EU and MEast don’t reach a deal, oil supply remains constrained, with oil prices going to be high. If supply is not fixed, when the Fed eventually lowers rates again, oil prices will soar back up.

The key to watch are movements by Saudi and the Rus/Ukr war.

11. US Credibility and rising rates:

As rates begin to rise, the debt servicing of outstanding treasury debt increases in tandem. As such, the Fed is facing yet another constrain when it comes to raising rates. If the market begins to be worried about the ability of the US government to service it’s debt, this will be the worst outcome for global financial markets. We might see a meltdown and a huge spike in the price of Gold. However, at this point in time, markets are not pricing this in.

To hedge against this possibility, it will be good to average into Gold when it drops below 1700.